INTRODUCTION SAP Analytics Cloud

In the Oil & Gas industry, where precision in budgeting and forecasting is crucial to navigating a complex and volatile environment, SAP Analytics Cloud (SAC) provides a unified platform for strategic planning, budgeting, and forecasting across the entire value chain—upstream, midstream, and downstream—empowering companies to manage operational risks and maintain profitability.

In this blog, we will explore how Oil & Gas companies can leverage SAP SAC for annual budgeting and why it is a game-changer for financial planning.

Topics we will be covering:

1. Driver-Based Planning for Budget Allocation & Profit Analysis

2. Scenario Planning & Simulations

3. Advanced Analytics & Visualizations

4. AI for Planning & Analytics

5. Data Integrations,Collaborative Planning & Compliance

Driver-Based Planning for Budget Allocation & Profit Analysis

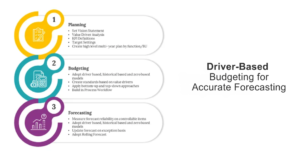

In an industry where operating costs, production volumes, and pricing are dynamic, driver-based budgeting provides a more granular and accurate forecasting approach. SAP SAC enables Oil & Gas companies to set up driver-based models, ensuring that budget forecasts are grounded in key operational metrics, with profit analysis both during and after budget allocation.

Some Key Drivers to Consider in CAPEX, OPEX, revenue, and cost planning in SAC:

CAPEX (Asset Planning): Capital expenditures involve significant investments in long-term assets, such as drilling rigs, production facilities, or infrastructure upgrades. Using driver-based models in SAC, companies can forecast asset planning needs based on key operational drivers such as:

- Production Volume: Higher production demands necessitate additional investments in assets like equipment, rigs, and infrastructure.

- Commodity Prices: Fluctuations in oil and gas prices directly influence the capital allocated to exploration, asset development, and infrastructure.

- Regulatory and Environmental Changes: Evolving environmental regulations may require companies to invest in more advanced technology or infrastructure to comply with sustainability targets. By integrating these drivers into SAC’s asset planning model, companies can forecast continuously adjust CAPEX budgets and asset investments to optimize capital efficiency.

- Asset Useful Life: Planning for new investments when the depreciated asset is scheduled forreplacement or maintenance to extend the asset’s useful life to avoid costly shutdowns.

OPEX Planning (Operational Efficiency): Operating expenses—ranging from labor costs to maintenance and materials—are key drivers of profitability. Using SAC’s driver-based models, companies can forecast and optimize OPEX with drivers like:

- Feedstock Prices and Availability: Volatility in feedstock prices (such as crude oil, natural gas, or other raw materials) significantly impacts OPEX, particularly in refining and downstream operations. SAC models can incorporate fluctuations in feedstock costs to help companies adjust procurement strategies and production volumes, ensuring efficient resource utilization while managing costs.

- Labour Costs: Workforce-related expenses, including wages and training costs, vary based on labour availability and automation levels. SAC’s dynamic forecasting helps companies project OPEX across multiple scenarios and adjust resource allocation to maintain cost control.

- Logistics Operation: Inventory levels, order volume, supplier lead time, and freight costs are used to plan budgets for transportation costs, inventory holding costs, warehouse and handling expenses, and technology for shipment tracking, ensuring all are optimized for cost-efficiency in logistics operations.

- Energy Prices: Changes in energy costs directly affect operational expenses, especially in energy-intensive processes such as refining and extraction.

Revenue Planning (Revenue Optimization): Revenue in the Oil & Gas industry is driven by key factors such as:

- Sales (Hydrocarbon Revenue, Non-Hydrocarbon Revenue): Allocate budgets based on historical sales in different segments.

- Commodity Prices: Market fluctuations in oil, gas, and other energy products have a direct impact on revenue generation.

- Production Volume: Higher production output generally results in increased revenue, but this must be balanced with operational efficiency.

- Market Demand: Global demand for energy resources is influenced by geopolitical factors, economic activity, and weather patterns. SAC’s driver-based models help companies forecast revenue with greater accuracy, allowing for better pricing strategies and market responsiveness.

Cost Planning (Cost Management): Costs across the Oil & Gas value chain, from feedstock to transportation, are influenced by several key drivers, such as:

- Feedstock Prices: Variations in feedstock costs directly affect production and operational costs

- Production Costs per Unit: Costs incurred per barrel or unit of energy produced are essential drivers for cost planning.

- Logistics and Transport: Transportation and logistics costs, including supply chain complexities and infrastructure investments, affect overall cost structures. SAC’s driver-based approach helps project and manage cost behaviour dynamically, providing accurate forecasts that support proactive financial management.

Scenario Planning and Simulations

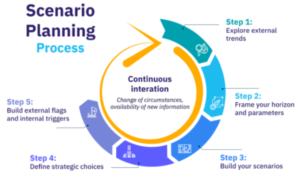

The Financial Modeller will be faced with numerous “what-if” questions from decision-makers and stakeholders, including management, the Executive Committee, and the Board. To address these questions, SAP Analytics Cloud’s VDT Trees (Value Driver Trees) allow companies to create multiple scenarios and simulate various outcomes. This capability helps leaders gain a clear, visual understanding of the financial impact of key decisions in a structured and insightful way.

Scenario Examples Using VDT Trees:

- Oil Price Sensitivity: Model how different oil price levels impact revenue, operating margins, and capital expenditure decisions through a VDT. The tree visually shows the relationship between oil prices, revenue, costs, and profitability.

What if oil prices drop by 20% or increase by 30%? How would this affect overall financial stability? The VDT Tree calculates the downstream impact on key financial indicators.

- Capex Adjustments: Simulate various capital investment strategies and their effect on long-term financial health with a VDT Tree that maps out the relationship between CAPEX, cash flow, and ROI.

What if CAPEX doubles? The tree dynamically adjusts the values for cost, return on investment, and net present value, showing how increased CAPEX could impact the overall financial model.

What if critical equipment is delayed or over-budget? The VDT Tree visualizes the cascading effects on both CAPEX and the project timeline, allowing quick assessment of financial risks.

- Supply Chain Disruptions: Evaluate the impact of supply chain disruptions due to geopolitical issues or environmental regulations through VDTs that link supply chain events to revenue, costs, and scheduling.

What if supply chain delays extend schedules by 6 months? The VDT Tree reflects changes in project timelines, recalculating operating costs and financial results.

What if labor costs increase by 25% due to global shortages? The VDT Tree models how these cost changes flow through the financial structure, adjusting forecasts for operating costs and profitability.

Advanced Analytics and Visualization

One of the strengths of SAP Analytics Cloud is its robust analytics and visualization capabilities. Oil & Gas companies can use SAC to create dashboards that provide a clear picture of financial performance and budget adherence. Advanced analytics capabilities help companies track KPIs in real time and make data-driven decisions.

Comprehensive Dashboards for Oil & Gas:

- Revenue and Cost Analysis: Visualize revenue trends against budgeted costs to quickly identify variances and take corrective actions where necessary.

- Capex vs. Opex Monitoring: Track capital expenditure projects alongside operational expenses, ensuring alignment with the budget and preventing overspending.

- Cash Flow Forecasting: Create real-time cash flow projections based on current and future budget expectations, facilitating proactive financial management.

- Finance Performance: Assess overall financial health by analyzing profit and loss (P&L), investments, and account positions.

- Upstream Direct Production Cost: Benchmark direct production costs per barrel of crude by cost type across districts, fields, wells, or completions. Simulate cost changes to optimize direct costs and meet efficiency targets.

- Downstream Portfolio Performance: Evaluate the performance of downstream and chemical business units’ product portfolios by analyzing contribution margins across different markets, regions, and customer segments.

- Downstream Supply Chain Performance:

Gross Refining Margin: Compare refineries’ profits by analyzing the gap between raw material costs and the value of produced petroleum products, supporting decisions on productivity, supply-demand balancing, and investments.

TSW Shipments: Monitor oil & gas shipments (TSW nominations) by factors such as carrier, transport mode, route, vehicle, and site to improve lead times and delivery quality.

- Capital and STO Projects: Enhance decision-making for capital and STO (Shutdowns, Turnarounds, and Outages) projects by evaluating budgets, costs, commercial value, risks, and ROI. Analyze budget deviations to ensure alignment with financial goals.

- Environment, Health, and Safety (EHS):

Greenhouse Gas Emissions: Track the progress of oil platforms, fields, terminals, and refineries toward reducing greenhouse gas emissions.

Risk Assessment: Analyze the risk landscape across operational units, comparing and assessing how effectively risk controls are being implemented.

AI for Planning & Analytics

AI for Planning and Analytics comprises a set of SAP Analytics Cloud features that enhance the analytics process using machine learning.

It includes Predictive Analytics, Smart Insights, Search to Insight, Smart Discovery, and Clustering.

- Predictive Analytics: Using historical data, SAP Analytics Cloud (SAC) can forecast future outcomes with advanced statistical algorithms such as linear regression, exponential smoothing, and others. In the oil and gas industry, SAC’s predictive analytics can be leveraged to forecast demand, optimize supply chain operations, and identify potential risks across the upstream, midstream, and downstream sectors. This enables companies to proactively manage production levels, streamline logistics, ensure refinery efficiency, and mitigate risks in fluctuating market conditions.

- Smart Insights: It identifies the key factors behind variances in operational data, such as production rates or equipment performance. It highlights the top contributors to issues like cost overruns or inefficiencies in upstream, midstream, and downstream operations. By adding context to visualizations, it helps quickly pinpoint the drivers behind anomalies, enabling more informed decision-making.

Data Integrations, Collaborative Planning and Compliance

Data Integrations

SAP SAC offers a unified platform that integrates financial, operational, and external market data, allowing companies to build comprehensive and flexible budgets.

Key Features:

- Real-time Data Integration: SAP SAC connects directly to your core ERP systems, such as SAP S/4HANA, SAP BPC (Embedded), SAP IBP, SAP Datasphere providing live data for financial planning. This ensures that your budgeting reflects the most recent operational realities.

- Import Data Integrations: It can connect with 34 SAP and non-SAP applications, also support connection to any cloud-based application using API.

- Transformations: It has various data transformation capabilities for preparing data before load.

By having all your data in one place, the budgeting process becomes streamlined, and you can make adjustments based on real-time market or internal shifts.

Collaborative Planning Across Departments

Oil & Gas companies operate in multiple locations and involve various departments, from finance to operations and IT. SAP Analytics Cloud promotes collaborative budgeting, ensuring that all relevant stakeholders contribute to the process, and departments are aligned.

Collaboration Features:

- Integrated Workflows: SAC enables collaborative workflows where finance, operations, and other departments can work together seamlessly including features like assigning or scheduling tasks.

- Version Control: Manage multiple budget versions and keep track of who made changes, promoting transparency in the budgeting process.

- Commenting & Annotations: Teams can communicate within the platform by leaving comments and annotations directly on the budget models, enhancing communication.

- Bookmarks: Provide features for creating global & private bookmarks.

Compliance and Regulatory Reporting

Given the regulatory complexities in the Oil & Gas sector, companies must ensure that their budgeting processes align with various compliance requirements. SAP Analytics Cloud allows companies to automate regulatory reporting, ensuring that all financial and operational data is easily accessible and auditable.

Key Benefits:

- Automated Reporting: SAC helps automate the generation of financial reports needed for regulatory compliance.

- Audit Trails: Ensure all budget changes are tracked and auditable.

- Global Compliance: For Oil & Gas companies operating in multiple countries, SAC supports compliance with various local financial regulations.

Conclusion

For Oil & Gas companies, budgeting is not just a financial exercise; it’s a strategic activity that determines the future of the business. SAP Analytics Cloud brings agility, accuracy, and collaboration to the annual budgeting process. With real-time data integration, driver-based models, and powerful analytics, SAC helps companies create budgets that are responsive to market dynamics and operational challenges.

At Trijotech, we specialize in helping Oil & Gas companies implement SAP Analytics Cloud for budgeting and planning. Our expertise ensures that you can harness the full power of SAC to transform your financial processes and gain a competitive edge.

For more insights on how to leverage SAP SAC for your budgeting needs, visit Trijotech.com.

To read more of our blogs you can surely click here.